A Market Outlook for 2025 and Beyond

By: Fitzsimons Innovation Community

CBRE is the world’s largest commercial real estate services and investment firm, providing services to both occupiers and investors in real estate, with a global presence and a focus on delivering real estate solutions. A respected industry thought leader, CBRE has a vertical practice group that focuses on the life sciences and biotech space. They are a valued partner and leasing agent for Fitzsimons Innovation Community, home to more than 80 visionary companies transforming the future of health and care. CBRE’s annual 2025 Life Sciences Outlook takes a deep dive into the forecast for life sciences real estate markets in the U.S.

We had the pleasure of speaking with David Saad, CBRE Executive Vice President who runs their life sciences group here in Denver. We’re excited to have him walk us through the report and provide additional insight into how it pertains to the Colorado market and what the future of life sciences real estate looks like in the Denver-Boulder-Aurora region, and specifically on the Fitzsimons Innovation Community campus.

While we encourage you to download the entire report here, let’s take a look at some of the highlights from the CBRE 2025 Life Sciences Outlook at a national level.

Some data and expectations from CBRE:

- Lab and research and development leasing activity trended higher in 2024, and that demand is expected to continue to improve in 2025.

- Stronger economic growth, friendlier capital markets, and record life sciences employment should reinforce greater demand for lab and office space in 2025.

- Annual venture capital funding grew by 10% year-over-year in Q3 2024 and was 10% higher than the pre-pandemic peak in 2019, possibly signaling better IPO activity in 2025.

- U.S. life sciences employment hit a record high in late 2024 and more job growth is expected in 2025.

- The life sciences industry continues to drive innovation and discovery. Novel drug approvals in 2024 were the sixth highest on record.

- The surplus of life sciences lab and R&D space will persist, with 16.6 million square feet under construction as of Q3 2024. While the vacancy rate may increase, the construction pipeline will ease by year-end.

Meanwhile, back at home…

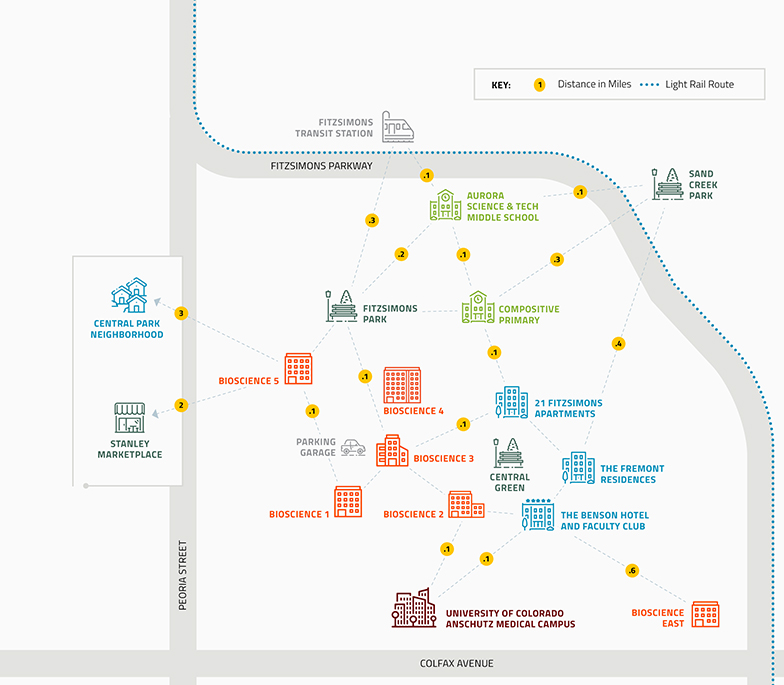

So, we asked Saad what this means for the Colorado market, and for Fitzsimons Innovation Community. A lot of good things. “When we talk about attracting talent to the Denver-Boulder-Aurora region, we can start with the way Fitzsimons Innovation Community draws people. This is an incredible development for so many reasons: the proximity to the University of Colorado Anschutz Medical campus, the acreage available for development, and the incubation aspect of the campus, just to start. People are attracted to living in Colorado; they already want to live here because the quality of life is so great. Add all the amazing research coming out of the medical campuses here, and it only sweetens the deal. Historically, Colorado has been a net exporter of science. With the new developments and expanding ecosystem in Colorado we see this trend reversing and it will allow for companies to get started and scale.”

All of this sounds great, but he warns there are some struggles in the market, as well. “At the end of the day, we have not seen the growth once anticipated. Early-stage companies have struggled raising capital combined with the interest rate environment has caused a lot of stress. The runway of liquidity that companies have is shorter right now.” David explains that we’re at the very early stages of what’s possible here in Colorado. “Colorado is an attractive market because of the existing intellectual capital, universities and research institutions, and competitive deal economics. Because of the ecosystem that Fitzsimons Innovation Community has created they have been very successful in creating and scale organic companies. There’s been a lot of great news from companies like Oncoverity and RefinedScience that continue to raise money in a difficult capital environment. Even in a rough investing market, it can be done.” He looks forward to more companies receiving funding and more important discoveries coming out the Colorado life sciences ecosystem, explaining that once we see that happen, the demand for biotech and life sciences real estate will improve.

Saad looks at Fitzsimons Innovation Community specifically as an example of how things can really turn around. “Fitzsimons hits all the components necessary for companies to be successful—it’s truly an ecosystem. We’re close to the airport, close to downtown, the existing real estate is phenomenal, and the additional space for future development is abundant. The CU Innovation Healthcare Fund allows for investment in new companies, and then you have all a university full of professors and scientists right across the street. It’s very synergistic. This whole campus has become a live, work, play environment and they’ve done a really nice job of creating that ecosystem.”

While the Colorado life sciences market is flourishing in so many ways, we asked Saad about what our state can do better, and he had one word: incentives. He worries that the incentive programs in Colorado are a detriment to the growth here and not competitive with other emerging markets. Things like tax credits, training grants and capital inducements aren’t as aggressive as North Carolina. Saad sees that hurting us, but still has positive views of the future. “For the next five years, I think we’ll continue growing. It maybe won’t be at as rapid of a pace that we anticipated a few years ago, but I see it being a net positive. We need to continue showing that companies are succeeding and growing here. This campus is a shining example of what can happen, even in a rough capital market,” he tells us. Thriving in uncertainty is something life sciences professionals—and Coloradans—do all the time, so we know Fitzsimons Innovation Community accepts the challenge and looks forward to a bright future.